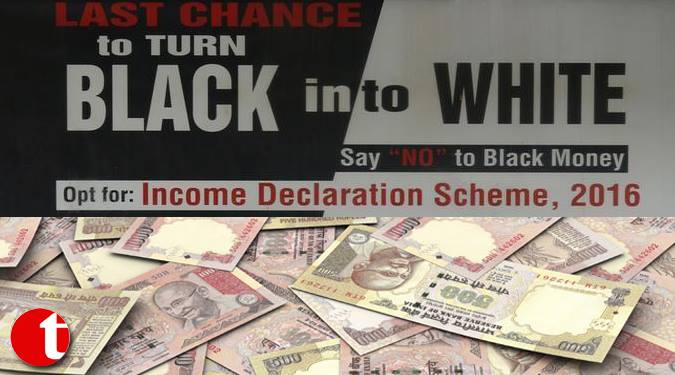

TIL Desk Business/ New Delhi/ Offering one last chance to black money holders, the government they have time until March-end to come clean by paying 50 per cent tax on bank deposits of junk currencies made post demonetisation.

Offering tax dodgers confidentially and immunity from prosecution under the new tax evasion amnesty scheme Pradhan Mantri Garib Kalyan Yojana, which kicks-in from tomorrow, Revenue Secretary Hasmukh Adhia said non disclosure of deposits made in banks after the Rs 500 and Rs 1000 notes were junked will attract stiffer penalties as well as prosecution.

Not declaring the black money under the scheme now, but showing it as income in the tax return form would lead to a total levy of 77.25 per cent in taxes and penalty. In case the disclosure is not made either using the scheme or in return, a further 10 per cent penalty on tax will be levied followed by prosecution, he said.

The PMGKY will commence on December 17 and shall remain open for declarations up to March 31. “Beginning tomorrow most of the banks will have challans to be filled for depositing tax for availing the PMGKY scheme. Only after payment of 50 per cent tax and setting aside the 25 per cent of the remaining undisclosed amount for 4 year, a person can avail the PMGKY scheme,” he said.