TIL Desk/Business/New Delhi-In a significant breakthrough in implementation of India’s biggest tax reform, the deadlock over administration of GST ended on Monday after the Centre agreed to allow states control over most of small taxpayers, but the rollout date was pushed back by 3 months to July 1.

The split of GST taxpayers between the two will be done horizontally with states getting to administer and control 90 per cent of the asseesses below INR 1.5 crore annual turnover, and the remaining 10 per cent coming under the Centre.

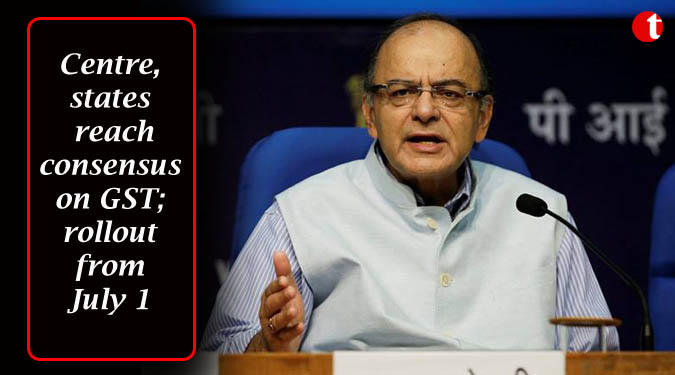

The Centre and states will share control of assessees with annual turnover of over INR 1.5 crore in 50:50 ratio even as Finance Minister Arun Jaitley insisted that each tax payer will be assessed only once and by only one authority.

Besides ceding control, the Centre also agreed to the demand of coastal states, allowing them to tax economic activity in 12 nautical miles even though constitutionally the Centre has jurisdiction over territorial waters. “This is a significant headway,” Jaitley said after the meeting.

While a four-rate tax slab of 5, 12, 18 and 28 per cent had already been reached, a consensus on the administration of the Goods and Services Tax – which will subsume central and state levies like excise duty, service tax and VAT – paved the way for finalisation of the draft supporting laws.