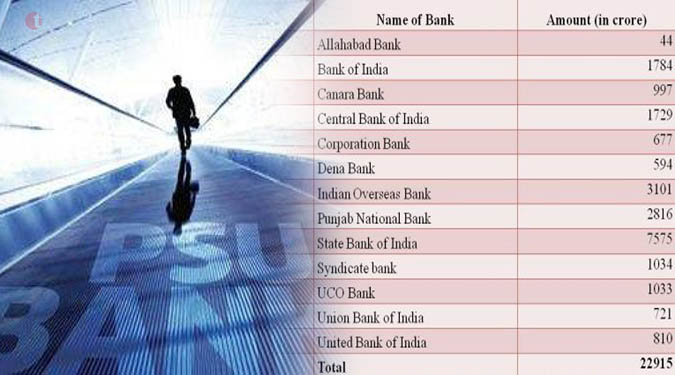

TIL Desk/Business/New Delhi-The government will infuse Rs 22,915 crore in 13 public sector banks for the current fiscal ending March 2017. The recapitalisation is aimed at shoring up the PSBs lending capacities that are restricted by poor asset quality and weak capitalisation.

Gross bad loans, as a proportion of the total advances by these banks, rose to 7.6 percent, a 12-year high in March 2016, according to the Reserve Bank of India’s latest financial stability report released on June 28.

Last year, the government had announced a revamp plan ‘Indradhanush’ to infuse Rs 70,000 crore in state-owned banks over four years, while they will have to raise a further Rs 1.1 lakh crore from markets to meet their capital requirements in line with global risk norms Basel-III. In line with the blueprint, PSU banks were given Rs 25,000 crore in the last fiscal. As per the plan, Rs 10,000 crore each would be infused in 2017-18 and 2018-19.