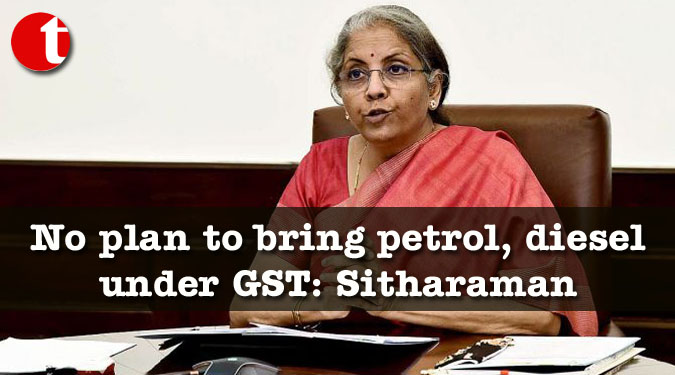

TIL Desk/Business/New Delhi/ Amid record-high fuel prices, Finance Minister Nirmala Sitharaman has said there is no proposal as of now to bring crude oil, petrol, diesel, jet fuel (ATF) and natural gas under the Goods and Services Tax (GST).

When the GST was introduced on July 1, 2017, amalgamating over a dozen central and state levies, five commodities – crude oil, natural gas, petrol, diesel, and aviation turbine fuel (ATF) – were kept out of its purview given the revenue dependence of the central and state governments on this sector.

This meant that the central government continued to levy excise duty on them while state governments charged VAT. These taxes, with excise duty, in particular, have been raised periodically.

While the taxes haven’t come down, a spike in global oil prices on demand recovery has pushed petrol and diesel to an all-time high, leading to demand for them come under the GST.” At present, there is no proposal to bring crude petroleum, petrol, diesel, ATF and natural gas under GST,” Sitharaman said in a written reply to a question in the Lok Sabha.